Back in the mid-1980's I spent a couple years working as a receptionist and legal secretary in a law firm. Have you ever noticed how law firms never have nice easy names like "Smith, Brown and Jones?" The one I worked in -- no kidding -- had the ponderous handle of "Laugenour, Johanson & Robinson." Try saying that fifty times a day on the telephone.

Anyway, sometimes the phones were pretty crazy; and so one year for Christmas one of my coworkers gave me a mug that said, "That line is still busy; will you hold till Monday?"

I thought it was hilarious because it expressed how I so often felt. (That's why I still have the mug after all these years.)

Well, that's how I've been feeling this week as I remain immersed in taxes.

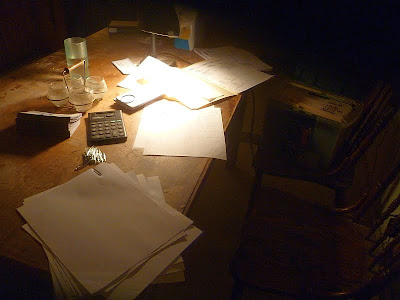

I've been putting everything else on hold while I crunch numbers. I don't use Quickbooks or any other computer program (I hate them!) so everything is done by hand.

But I'm making progress. Excellent progress. In fact, I should be done by tomorrow. Then I can re-emerge to join the living and might even answer some calls... er, emails.

Please stand by.......

.

ReplyDeleteCows and cowgirls, YeeeHaww und JAAAWOHL !

When I saw this I thought of Patrice and Company.

Enjoy.

http://www.youtube.com/watch?v=18UPCJdt08k

.

It's been ages since I had to deal with craft biz paperwork, long enough to be pre-computer days.....I use to use file jackets for each month, put all the receipts in it and copies of vendor invoices (main one would be in the vendor file)....I'd make notes about the month on the outside of the jackets (shows/sales, any non receipt type records, mini totals)....then at the end of the year just work from those, and afterwards they'd be the storage as well.....

ReplyDeleteI also had a notebook with all the monthly info, for future planning purposes.....

Worse part was keeping track of what's separate and what parts of being a home based business was allowed, and every year I'd swear that the next year I'd take one day at the end of the month and do a pre-year-end total (to make the end go faster) but in reality that never did get accomplished....

I can't imagine how chaotic having multiple home based business' is to keep track of.....the worst part of a self owned business is all the ridiculous amounts of paperwork you end up with......I hope that's wine in the glass in the picture, LOL

Excellent overview, it pointed me out something I didn’t realize before. I should encourage for your wonderful work. . I am hoping the same best work from you in the future as well. Thank you for sharing this information with us.

ReplyDeleteI know the feeling. I just finished up our taxes for our farm/us and each of our three daughters who have to file. I can't afford an accountant, so it's just me,Turbotax, and a whole bunch of numbers. This is the latest I've ever been. And now that I've finished them, the government is going to shut down. Of course, the good news there is: if the government is shut down, we're automatically cutting spending.

ReplyDeleteWith you there, Patrice. Groan....I am doing the same thing and wishing I were an accountant. I hate, hate, hate this time of year. Why? It isn't because of the money - it's because of the paperwork and brain overload. My head hurts!!!

ReplyDeleteYou take your time, Patrice. We can wait, because YOU are worth waiting for!!

ReplyDeleteBill Smith

Hi Patrice,

ReplyDeleteI emphasize with you on your trials during tax time.

However, I really do believe you should let the computer help you with it a bit. I'm 60 years old, and I've always done my own taxes. But, I have to admit that the last few years of using TurboTax have been the least painful, least stressful times of all.

The beauty of computerized taxes is that each year's tax information carries over to the new year, saving a ton of time in filling out redundant boilerplate information. Plus, the software "knows" things that you might not know to catch, pulls up forms that you never knew you needed, and "reminds" you of things that would be costly for you to miss.

I've been self-employed for the past 11 years, and employ my children in my business. I can't even imagine having to take care of all that paperwork by hand.

To me, tax time is not particularly stressful or time consuming. I basically block out the rough draft in two or three hours. Then I let it "cook" for a couple of days to see if anything comes to mind that I need to change. Then, I take a few minutes to make changes and firm things up. I e-file, so it takes a couple of minutes to send it along. No paperwork to mail. In 8-10 days I've got my refund. I'm usually all done by the first week in February.

There is NO WAY that I could do that without my Quickbooks and TurboTax. And, I'll repeat, I have a home-based business with a dozen vendors and 40-50 customers. And I employ my two children, deduct for a vehicle, take a home-office deduction, etc.

By the way, did you know that you can employ your children, even as young as 12 years old? You can earn significant deductions for what you pay them. Your children clearly help you with your farm and craft business, so they definitely qualify.

Dave

No apology needed. Lots of luck to you.

ReplyDeletePatrice, at some point you are just going to have to bite the bullet and get some software to help you run your business. I know the feeling of always wanting your fingers on the pulse of what you are doing, hence the "no software help" edict. The learning curve is steep, but well worth the effort. Rather than thinking about the additonal time you'll have with the blog, think about the additional time you'll have with the clan.

ReplyDeleteI will miss you. Your pictures are my favorite.

ReplyDelete