Well as if I haven't been silent enough (on the blog) because of our unexpectedly busy tankard orders, now I'm burying myself in taxes. Ug.

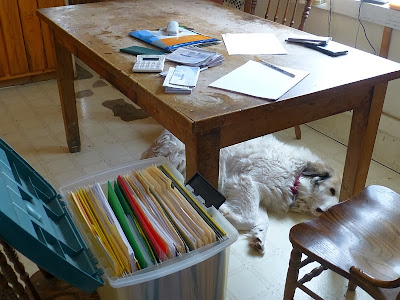

I hate using computer programs for doing taxes. Instead I do it the old-fashioned way -- pencil and paper. Literally.

Our tax appointment is Feb 18. I scheduled it very early this year because there's a lot of uncertainty and changes in tax stuff, so I wanted to give us enough time to pull together funds just in case we owe money.

I'll try not to be as silent on the blog as last week, but just thought I'd let you know what we've been up to lately. Taxes. Ug!!!

I do so understand. God bless.

ReplyDeleteI do taxes the same way you do, although I think in the near future we will all be forced to efile.

ReplyDeleteA tax preparer told me you have a better chance of not being audited if you file as close to April 15 as possible, so I, like you, figure them out early and file later.

Good luck with all the legalese in the tax code!

Patrice,

ReplyDeleteTaxes UG........is so true!!!!

Talking about software, it took us 5 days to get the software to load this year. When we finally got the stuff loaded, doing the taxes was a cake walk. I'm not very happy because we no longer have kids as deductions, there all grown and doing their own taxes.

Hello Patrice, the film follows he was brought to your attention? It takes about 2 hours, but is incredibly well documented, it has been viewed more than 7,000,000 times. Curiously, the passage explaining how we can prosper by accessing the free energy and why they prevent us from doing for decades, joined a Native American prophecy Cheppewa No Eyes: innovations in the field of energy with the use of magnetic field of the Earth:

ReplyDeletehttp://www.youtube.com/watch?v=lEV5AFFcZ-s&list=PLED97AFA83A4B77B8&feature=c4-overview-vl

Sorry for my accent !

Trystia

As farmers, we do most of our taxes BEFORE the end of the year because we want to pay little to no taxes. If we have too much income, we make legitimate purchases to offset that as much as possible. Then there are no surprises come tax filing time.

ReplyDeleteJust a comment and if you are already doing these things it is still good info for everyone. You should plan your taxes 6 months and then again 30 days before the end of your tax year. If your taxes are complicated then do this with a tax preparer. You should also use a tax preparer to actually compute and file your taxes if your tax situation is at all complicated. I am not suggesting that you use the tax preparers that set up a table in Walmart or the mall. They might be good at what they do but more likely they are more attuned to filing for welfare people and getting the EITC and their experience with complicated taxes is quite limited. Good planning can often save money especially for anyone with a small business.

ReplyDeleteWell, I guess the unexpected tankard orders are a Blessing AND a curse?

ReplyDeleteMay you get your money back this year!

Steve