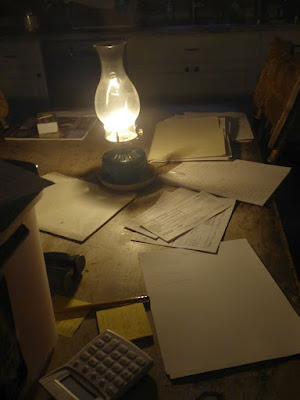

We had a power outage the other day, for several hours. This is nothing unusual. We have power outages when it's snowy, rainy, windy, a Tuesday...

That's why we keep oil lamps handy at all times.

But this time when the lights went out, I was in the middle of doing our taxes. No problem. I just continued with what I was doing (particularly since I always do our taxes by hand).

An old-fashioned solution to a modern problem.

(Update: One reader asked why I do taxes by hand. Short answer: Because I'm a Luddite. I tried tax software years ago and hated it. Too much stress. Doing taxes by hand is much easier for me.)

(Second update: A reader expressed concern about doing our own taxes, and recommended we use a CPA. My apologies for not being clearer; that's precisely what we do. First, however, I have to crunch the numbers and document all our income and expenses for our various Schedule C home businesses (which is what I was doing in the photo above), and then hand everything over to the CPA, who then waves a magic wand before having us affix our signatures to the results. Worth every penny, in my humble opinion.)

Why do your taxes by hand?

ReplyDeleteYou're right. It's easier.

ReplyDeleteI agree, its easier, and Cheaper!

ReplyDeleteLove it. I’m also not a fan of the softwares... I keep records by hand too, in a dome record keeping book. So much more enjoyable! Cheers from another Idaho homemaker. Www.Pineconehomestead.com

ReplyDeleteI have hesitated to post this but feel that I should and let you chose what you will. I would advise taking your taxes to a CPA who does taxes (they all might do some taxes but some do more and thus have more experience). You may be doing you taxes perfectly but you may not be. There is so much to know and so many unknown unknowns. Don't take them to a national tax preparer company, we all know those names, or someone who does taxes in Walmart. They specialize in welfare and illegal alien taxes and not common man taxes. Simple tax return by a CPA can be in the $300 range, Not a small amount but not too large either.

ReplyDeleteWhy, you ask. Well the obvious reason to make sure you are not making any mistakes that cost you money or leave you at risk of owing money.

Before we retired and had a business we took our taxes to a CPA at the cost of $410.00. This year we only had our SS 1099's so our son willingly did them for us. We don't owe anything, we made less than $40,000.00 so we felt safe in doing this.

ReplyDelete"We don't owe anything" I often here that. But what exactly does it mean. If I paid no taxes I would say I don't owe anything. But if I paid taxes and my withholding was sufficient I would not use that phrase because of the confusion. So did you mean with $40,000 you pay zero taxes or did you mean that the IRS already took what you would have owed by withholding?

Delete